USA Credit Card Basics for First Timers: Limit, Due Date, Rewards, more.

Credit card is America’s widely accepted payment method more than debit card, cash or cheque etc. So anyone already in the US or planning to migrate should have basic understanding of credit card system in the USA before applying for it.

And here’s the guide for everyone wanting to know more about this plastic money.

To make it simple, a credit card has:

- It’s own attached account (one card for one account), which can be created on the Internet

- A fixed credit limit (maximum amount of expenses per month)

- A fixed repayment date per month (by which the minimum amount must be repaid).

What is the monthly spending limit?

Once your bank accepts your credit card application, they will send you your credit line or credit limit, which is the maximum amount they will lend you per month. The credit limit is the spending limit you cannot exceed per month. It can range from $500 to several thousand dollars, depending on your credit score. The higher your credit score, the higher would be the credit limit. So for the first timers, expect to have the lowest credit limit of only $500 and possibly the most basic credit card. But remember very few banks offer credit card for first timers especially when you don’t have credit history. Other option is to get Secured credit card in USA.

Be careful, the credit limit does not mean that you have target of spending it to the maximum! Experts advise you not to spend more than 50% of your credit line. If it is $500, you will not have to spend more than $250 with this credit card. Some even say that it is even better to spend only 20% of the credit line. Although there is no proof to these recommendations.

So if you ask why to follow these rules then frankly there is no answer yet! Apparently, this is because the good payers are considered as people who do not consume all that is made available to them. Basically, it is to be sure to repay at the end.

One question that will seem important to you is…

Paying on credit is good, but do you have to pay interest?

Answer is NO. If you repay your credit correctly, that is, the total amount you owe your bank every month on/before the due date, then you won’t have to pay any fees. To know your payments, you can check your account online or call the credit card company. You will have information on the minimum amount to pay, and your deadline.

However, be careful not to forget to repay before the due date! If the minimum amount is not paid, high penalties apply. And if you pay only the minimum, interest will be charged for each day of delay, and rates can be very high, depending on your credit score. The lower it is, the higher the rates will be. For some it could be 12.5% whereas for others it could be 25%.

So at first, be very careful! Forgetting will also negatively impact your credit history. Don’t forget you’re traced, it will mean you’re not a good payer! So hope you have understood, the credit card requires regular monitoring and a certain discipline.

Aspects to be taken into account in order to be reasonably indebted

There’s a saying – Don’t consume what you don’t have!

And the same applies with credit cards. In the United States, you have to get into debt to exist. And this system carries risks!

Be careful not to fall into the credit spiral! You can have multiple credit cards, so multiply the borrowing limits (credit limit). Remember, this amount of money, which you see on each of your credit card accounts, is not yours!

As mentioned above, you can only repay the minimum amount set by the bank per month. Be careful not to abuse this system! You’ll have to pay that money sooner or later, plus interest on every day, if you’re late! Moreover, you will continue to consume, so be careful not to accumulate your debts! This game can become very quickly dangerous… And more cards you have, the more dangerous this game becomes!

Remember the primary purpose of the credit card, is to build your credit history, in order to have the best credit score possible. So for reasonable use, it is advisable to use it as a deferred debit card for your domestic purchases, and to refund your credit every month, in full, a few days before the deadline. This is how you will increase your credit score! That’s what honest card users do and never have a problem. It is also possible to set up direct debits (usually online).

The advantages: the different types of rewards

We have seen the risks and dangers above, but if you use your card wisely, you can even save/earn good amount of money! Credit cards offer certain rewards in the form of points, when you have consumed correctly, which can then be converted into money. Cool, right?

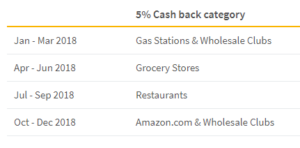

5% cash back – Discover it® - Cashback Match™

For example, here’s one such card. User is entitled to earn cash back up to 5%. From January to March, 5% cashback at gas stations. The following month, it is for the purchase at grocery stores. To summarize, you pay through your card, and then, have the refund, called “cash back”. It’s not bad, is it?

For example, here’s one such card. User is entitled to earn cash back up to 5%. From January to March, 5% cashback at gas stations. The following month, it is for the purchase at grocery stores. To summarize, you pay through your card, and then, have the refund, called “cash back”. It’s not bad, is it?

Be careful not to confuse the cash back of the credit card with the cash back of the debit card. When you arrive at a store checkout to pay with your debit card, the card reader will ask you if you want cash back. This is if you want to withdraw cash from your account (like at a ATM) free of charge, which is by the way, very convenient!

But rewards do not only concern cash back, but also miles (loyalty points) for airlines. It all depends on the type of card and your needs. If you often fly, you will need a credit card with loyalty points, miles, etc….

But remember! If you don’t have a credit history yet, then you won’t have too many choices at first… One thing is for sure, this system reflects the consumer society well! And everything is based on this banking system! But that said, don’t buy any more than usual…

Finally – a quick summary of the US credit card basics for everyone

Once you have your credit card approved by the bank, you must know:

- Your credit limit, spending limit per month (do not spend more than 50% of this limit per month).

- The repayment due date per month (date on which you must repay the total amount, if possible).

- Access to your account to track your card spending, and pay off your debts online every month, before the due date.

- Your rewards that will guide you on when and where it makes the most sense to use your card.