Calculate Interest On Savings Account – How Banks Do It – New & Old Method

Calculating Interest On Your Savings Account in Bank

Savings bank account interest calculation by banks in India as per the new RBI guidelines is based on daily products. i.e. the balances outstanding as at the end of the day. The old method which banks used to calculate interest on savings interest was based on minimum balance kept in the a/c from 10th of any month and last working day of that month. But as per the revised RBI guidelines; the old method was changed (with effect from 01st April 2010). RBI deregulated the interest calculated on savings account which permitted banks to set their own rate of interest on the savings bank account.

Some banks pay interest on savings interest every half year. i.e. For Jan to Jun balances, banks credit interest in the person’s account in the 1st week of July. And for the balances kept in between July to Dec, bank pays interest in the 1st week of Jan every year.

Some banks pay interest on savings account once in a year, i.e For Jan’11 to Dec’11 balances, interest gets credited in the account in the 1st week of Jan’12.

New & Old Method of Savings Interest Calculation – Example

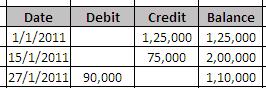

Let’s understand the savings interest calculation (New Vs. Old) with an example. We’ll assume a/c statement as given in Fig.A below. All figures are in INR.

|

| Savings Bank Account Statement |

Calculating Interest as per the OLD method:

Following formula was applicable till 31st March 2010:

Savings Interest (Old Method) = (Minimum balance between 10th and last working day of that month*Rate of Interest*No. of Months In A Year)

So old rate of interest you’d received = 110000*4*1/12*100= 366.66 INR

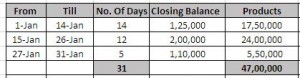

Revised (New) method of calculating interest on savings account: (Applicable From 01 Apr 2010 as per the RBI guidelines): Refer below figure:

|

| Savings Bank Interest Calculation As Per New RBI Rule |

Savings Interest (New Method): (Products*Rate of Interest*No. of days in that month)/365*100

Where Products = No.of days * Closing Balance

So, the interest you’ll receive = 47,00,000*4*31/36500 = 515.06 INR

Clearly the new guideline has bought happiness to the account holder since he’ll see more balance in the account at the end of the month.