Atal Pension Yojana: Subscriber Registration Form

Atal pension yojana with an objective of providing monthly pension to the citizens from unorganized sector of India was declared during the union budget of 2015-2016. The condition is that the citizen should not have any other formal pension benefits. The scheme aims to generate corpus for retirement.

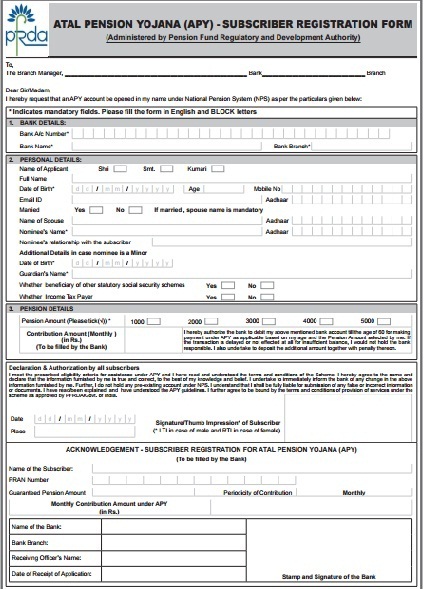

Atal Pension Yojana subscriber form is very simple and contains following fields:

- Bank Details:

- Bank account number

- Bank name

- Bank branch

Here is the snapshot of the form:

2. Personal Details: Full name of the applicant (first name, last name and middle name), date of birth, age, mobile number, E-mail ID, Aadhaar number, marital status

3. Full name of the spouse (first name, last name, middle name)

4. Full name of the nominee (first name, last name, middle name)

5. Relationship with the subscriber

6. If nominee is a minor, date of birth and guardian’s name

7. Whether you (i.e. subscriber) are a beneficiary of any other social security scheme

8. Whether you are a income tax payer

9. Pension Details: How much pension you wish to receive after 60 years: Select as per your need: Rs. 1000-Rs. 5000. Check out the pension and contribution chart for APY

Once all the details are entered correctly, you need to mention – date, place and provide signature/thumb impression. If you are a male, provide left thumb impression. If female, provide right thumb impression.

Finally you will receive, acknowledgement receipt containing following details:

- Subscriber’s Name

- PRAN number

- Guaranteed pension amount

- Period for which contribution will be made

- Monthly contribution amount

- Name of the bank

- Bank of the branch

- Receiving officer’s name

- Date application was receiver by the authority

Keep this acknowledgement slip with proper care as you might need it any time in the future. Best is to take a picture and store it as a soft copy. Read more about the features of APY.

If someone is a subscriber of Swavalamban scheme then that individual would be automatically migrated to Atal Pension Yojana unless they opt out.

sivagami

my age is 40years and 8 months this scheme wil be eligble for me

sweety

Sir mujko yah service closed karni hai kasie possible hai…

Plz help me …..because marie pass job nahi hai .. Plz replied me

j thomas

I would like to ask you My age is 14th April 1974 can I join this scheme ?

prabinder mallick

great job by modi & his company, it is useful for future for downtrodden people.

Nityanand Haldar

Nice scheme By MODI govt. its good to see that. All can take benefit by this Scheme. At-least they can thing above there limit to contributing small amount

AllOnMoney.Com

You’re right Nityanandji.

Atul

if I opt for 5000 per month after 60 year as a pension..so till which age I will recived that amount after 60 year

And

If subscriber death occure during contribution period and if after 60 year then will nominee get insurance?