SBI mCASH: How to Claim, Benefits, Features, Transfer Money, Charges

The State Bank of India (SBI) mCASH app is a mobile application provided by SBI that enables you to transfer money to anyone in your contact list without knowing their bank account details. It is a convenient method for sending money to friends and family quickly.

Requirement

Customer should have SBI online banking facility enabled in order to send money. Also the transfer is possible within SBI group or IMPS enabled banks.

How to Transfer

As mentioned above the transfer process is very simple and only details required are beneficiary’s mobile number or E-mail ID. No need of bank account details such account number, IFSC code etc. which are normally required when transferring the funds.

Charges: Minimum charge for each transaction is Rs. 2.50

Transfer Limit: Rs. 1,000 per transaction and Rs. 2,000 per day per user.

How can beneficiary claim money and other requirements:

Beneficiaries should have bank account and they can receive money in 2 ways depending on the option chosen by the sender as follows:

- Through mobile banking application (mCASH) which needs to be installed on their mobile phones with Android and Apple iOS and Blackberry.

- Link sent on E-mail

- Along with this, 8 digit passcode will also be sent to the receiver which needs to be entered on the SBI mCASH link available before pre-login of online SBI or mCASH mobile application for claiming the funds.

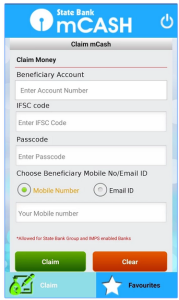

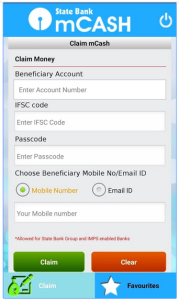

- After this, beneficiary needs to enter account number, IFSC code, passcode, choose from the 2 options: E-mail ID and mobile number and enter the same.

When does money get transferred: It is instant and funds are transferred in the real time.

Is the transaction Secured:

SBI claims that the mCASH app is extremely secured as none of the details are saved in the mobile phone and SSL encryption is used. Also if the app is unused for more than 5 minutes, it gets closed automatically.

Other features of this app:

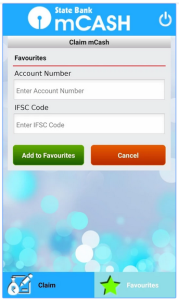

The mobile application also has functionality to save the account number and IFSC code through the “Favourites” section.

Features of SBI mCASH app:

Ease of Use: The mCASH app is designed to be user-friendly. Once you download and install it on your smartphone, you can link your bank account to it. You can use your SBI account or other bank accounts, making it versatile.

Contact-Based Payments: One of the standout features of the mCASH app is its ability to send money to your contacts without needing to know their bank account details. You can simply select a contact from your phone’s address book and send them money. This feature can be quite handy when you owe money to a friend or need to split expenses.

Virtual Payment Address (VPA): To use the app effectively, you will need to create a Virtual Payment Address (VPA). This serves as an alias for your bank account, making it easier for others to send you money. VPAs are in the format of “yourname@sbi” or “yourname@otherbank.” You can share your VPA with others, and they can use it to send you money.

Security: Security is a top priority for any financial app. The mCASH app incorporates various security measures to protect your transactions and data. It uses secure authentication methods, including PIN and OTP verification, to ensure that only you can access your account.

Transaction History: The app provides a transaction history so you can keep track of all your payments and receipts. This feature helps you monitor your financial activities effectively.

Bill Payments: In addition to person-to-person payments, you can use the mCASH app to pay bills, such as electricity, water, and mobile phone bills. This feature can save you time and effort, as you can make these payments from the comfort of your smartphone.

Customer Support: SBI typically offers good customer support for its apps. If you encounter any issues or have questions about the mCASH app, you can reach out to their customer service for assistance.

Updates and Improvements: Like any mobile app, the mCASH app undergoes updates and improvements. Make sure to keep your app updated to benefit from the latest features and security enhancements.

In conclusion, the SBI mCASH app is a useful tool for quick and easy money transfers to your contacts, as well as for paying bills. It is a secure way to manage your finances on your mobile device. However, it is important to always follow security best practices and keep your app updated to ensure a safe and seamless user experience.

Here are the images of mCASH app:

Request to the readers: Please mention your feedback about this app through the comments section below.

Hi, I am Nikesh Mehta, owner and writer of this site. I’m an analytics professional and also love writing on finance and related industry. I’ve done online course in Financial Markets and Investment Strategy from Indian School of Business. I can be reached at nikeshmehta@allonmoney.com.