Post COVID Personal Finance: Start Thinking from Today Itself

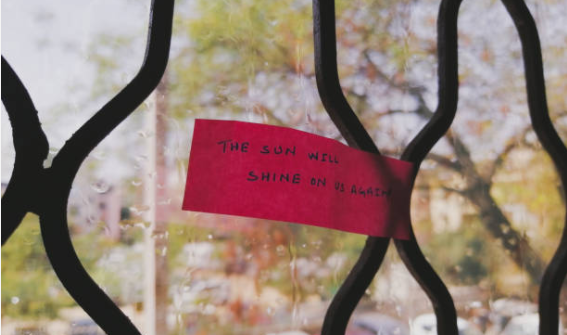

Covid-19 pandemic will never be forgotten by this generation as it has shattered the lives of people across the globe; both financially and personally. Despite the reactivation of certain industries, every country is still going through difficult situation such as unemployment, decreased income, among other contingencies.

But at the same time, it has taught important financial lessons to everyone. However life has to move on and everyone should think about preparing themselves for having healthy personal finance for the post-covid life.

Although this is too early to talk as there are no signs of Covid completely gone, as the only hope the whole world has is the effective vaccine which is under the testing stage.

Being concerned about the current situation is normal. But the time has come to start thinking about the state of our personal finances and to prepare the ground for the time when 2021 arrives or the pandemic begins to pass and we resume our daily routine.

Are you ready to face the post-pandemic world?

If you’re back to daily routine and your income and expenses have changed, it’s time to get back to the basics of personal finance.

Create your financial strategy

It is very likely that your budget has undergone changes or adjustments, from very simple to very complex, from not eating out to ordering the food at home, delaying buying of clothes, gadgets etc. or even possibilities of savings. When your expenses resume their pace, you should consider how to use your money efficiently.

The important recommendations are:

- Detect the areas of opportunities where you can save.

- Prepare a weekly, monthly or half-yearly budget (as you prefer), where the central point is your fixed expenses.

- Detect your small expenses to keep track of them and reduce them as much as possible.

- Set aside little bit of fund for a future emergency or unforeseen event.

- Have clear and achievable financial goals.

- Set clear financial objectives for the short, medium and long term.

Your objectives must be achievable and you must be able to measure them.

These objectives could be:

- Liquidating a credit

- Saving for a trip

- Buy something you want or need

- Remodeling your house

- Fixing something of your car or changing it

- Investment

- Acquiring a life insurance or

- Home etc.

Establish how much money you need, how long you want to achieve it, and how much money you will set aside in each fortnight to achieve this goal. Let it become a habit! Reduce your unnecessary expenses and get ready to reach your goals.

Change your routine without fear

Don’t be afraid to make changes in your daily routine. Implement changes that will help you have achieve healthy financials. By doing this, if any eventuality strikes in the future, you will have sufficient money to face it. These small changes will add up and reflected in your pocket and in your savings account. A small change can make a big difference so don’t overlook it.

Each one of us has different realities, lives and habits. It doesn’t matter what yours are. The important thing is that you adapt so that you can also change your mentality regarding money.

Conclusion:

Therefore during such uncertain scenario, it is vital to take care of the finances and start managing the money better and prepare to be more financially resilient once we all return to the new normal.

Author Bio:

I am Nikesh Mehta, sole owner and writer of this site.

I’m an analytics and digital marketing professional and also love writing on finance and technology industry during my spare time. I can be reached at nikeshmehta@allonmoney.com or LinkedIn profile.