Pradhan Mantri Garib Kalyan Deposit Scheme: Application Form, Tax, FAQs, Benefits

Government is giving the last and final chance to all the tax evaders to deposit their unaccounted income through Pradhan Mantri Garib Kalyan Deposit Scheme (PMGKDS), a newly launched scheme. Part of money collected through PMGKDS will be infused into social security schemes run by the government of India i.e. for the welfare of the poor people. It is a fresh crackdown on the black money holders and a final last chance.

What is PMGKDS?

It is a new income disclosure scheme announced on 16th December 2016. The scheme will allow all the tax evaders or black money holders to disclose their unaccounted/accounted income by paying higher tax.

What taxes will have to paid?

Any individual declaring undisclosed income will have to pay multiple types of taxes as follows:

- 30% tax on income

- 33% as surcharge tax

- 10% penalty on the overall income

- 25% of total declared amount for PMGKDS

When will the disclosure scheme start and end?

Scheme start date will be 17th December 2016 and end on 31st March 2017.

For what purpose this money will be used and what are the benefits?

Money collected through Pradhan Mantri Garib Kalyan Deposit Scheme will be used for various social security schemes which are mainly aimed for the benefiting the poor people. The lock-in period under the scheme will be 4 years.

Few of the social schemes announced by the government are:

- Jeevan Jyoti Bima Yojana

- Suraksha Bima Yojana

- Jan Dhan Yojana

- Sukanya Samriddhi Yojana

- Awas Yojana

- Atal Pension Yojana

- Digital India

- Gram Sadak Yojana

- Rashtriya Swashtha Yojana

How to deposit the undisclosed wealth and contribute to PMGKDS?

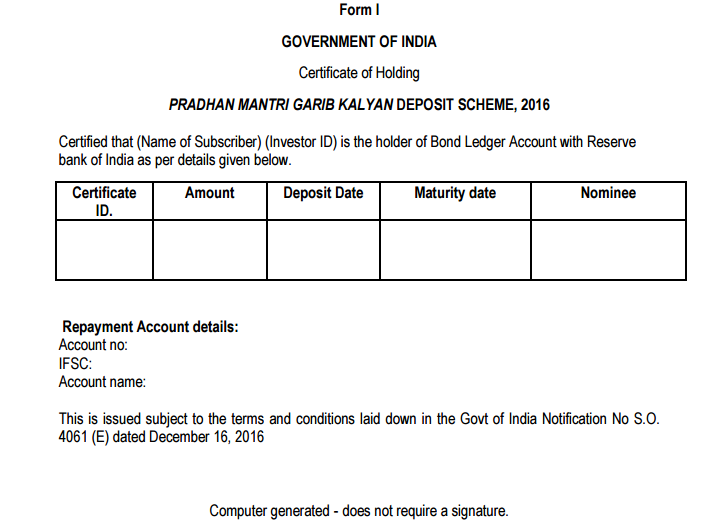

Individuals will have to deposit money in the bank along with the application form. Banks will have to send these details to department of Revenue, Ministry of Finance, and Government of India. And also upload the details of the deposits to RBI’s core banking solution. RBI will maintain Bonds Ledger Account for the deposits. Upon declaring, certificate of holding will be given to the declaration. Here’s the official snapshot of the certificate released on the RBI website.

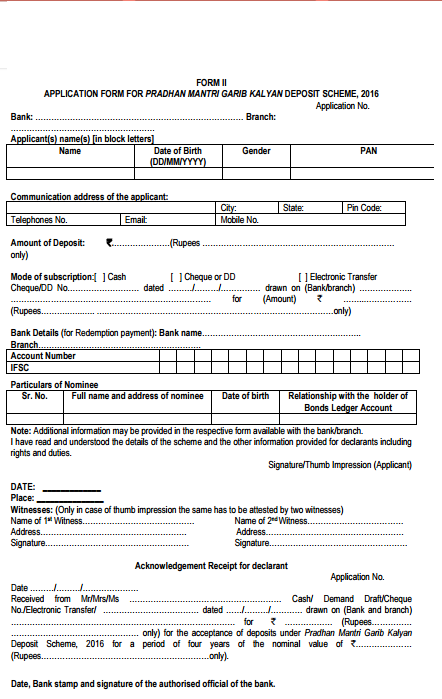

Application form for PMGKDS is as shown in the below image:

You can also download the application form from this official RBI’s website link.

Will the declarant get deposited back?

Yes, but after 4 years of lock-in period. If declarant dies, then money will be repaid/transferred to the nominee. Nomination facility is also available while declaring the money. No interest will be paid on the repayment amount.

What are the payment modes for depositing the money?

Deposits can be made in the form of cash/cheque/demand draft in the authorized bank.

What are the documents required while disclosing unaccounted income?

Declarant will have to furnish PAN details, bank account details, nominee details along with the nominee’s bank account details.

What if someone fails to declare the income by 31st March 2017?

On such individuals government is expected to take criminal action along with a penalty by charging very high tax.

How can someone reach income tax department if they have information on such black money holders?

Individuals with any information related to black money can E-mail I-T department on blackmoneyinfo@incometax.gov.in. Everyone should come forward and make a pledge to help government in this initiative by giving whatever information you have about black money. This will make India an economic super power soon.

For clarification or queries related to PMGKDS, you can E-mail RBI on cgmidmd@rbi.org.in.