2019 Will Recession Hit? 12 Signs to Watch Out

Will the recession start in 2019 in the United States?

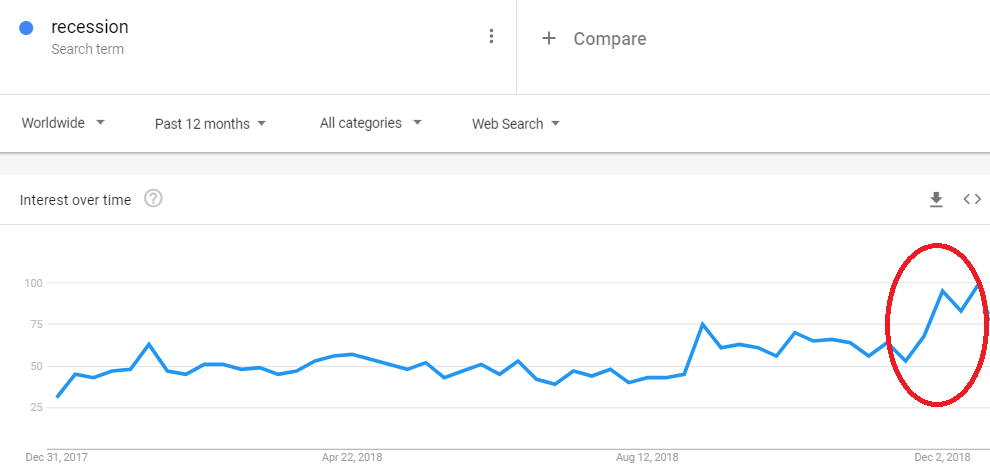

This is turning out to be a big question and the below graph from Google trends justifies the curiosity from the users across the world.

But before digging into more detail, first let’s understand what does recession mean?

Recession: An economic recession occurs when there is a fall in economic activity over a given period of time, mainly two consecutive quarters. Thus, when GDP falls for two consecutive quarters, it is considered as the first sign of recession.

Economic Depression: If the recession is strong and long-lasting, it is known as an economic depression.

Recently there has been news at the wall street revolving about the hypothetical economic recession that would invade the USA in 2019. Investment management firm – Bridgewater Associates and JPMorgan Chase, a leading investment banking company, believe that fiscal and monetary policies will cause serious setbacks in a period of approximately 2 years in two years.

The main argument they put forward is that an increase in inflation could lead the Fed to accelerate interest rate hike, which could slow the path of economic growth.

But the most disturbing fact is that if the US goes into recession, the possibility that other non-emerging economies will also get impacted is 70%.

You know the saying that when the United States sneezes the rest of the world gets the flu.

Can recession be predicted?

It’s not easy. But there are a number of unequivocal signs that can at least alert us to the potential or inherent risks:

- Rising prices

- Interesting rises in the stock markets

- Increase in house prices

- Increase in household indebtedness

- Plunging crude prices

- Credit crunch

- Drop in investors’ confidence

- Increase in unemployment rate

- Slow growth in new jobs addition

- Drop in vehicle sales

- Geopolitical crisis

- Consumer spending slows down

Yes, it is said that after an inverted yield curve, a recession usually hits and this has happened in the last 60 years. It occurs when the yields of short term bonds exceed those of long term. Or when long term bonds fall below short term yields, it is more interesting.

Does recession hits immediately?

The positive side is that a recession does not occur immediately after an inverted curve, on average 19 months have to pass. In addition, the average yield of the S&P 500 index from the date of the curve reversal to the recession was 12.7%. Investors should not be nervous.

Be that as it may, investors prefer to make their own judgement i.e. take advantage of the day and do not trust in tomorrow. And so it is.

Investors didn’t waste any time and took advantage of the strong rises in the stock market in recent years, all supported by the economic expansion that began in the summer of 2009.

Remember, recession is inevitable.

Author Bio:

Hi, I am Nikesh Mehta owner and writer of this site.

I’m an analytics professional and also love writing on finance and related industry. I’ve done online course in Financial Markets and Investment Strategy from Indian School of Business.

I’m an analytics professional and also love writing on finance and related industry. I’ve done online course in Financial Markets and Investment Strategy from Indian School of Business.

I can be reached at nikeshmehta@allonmoney.com. You may also visit my LinkedIn profile.