FICO Score in USA: Guide for Migrants

A credit score is a score between 300 and 900 points that is used to determine the likelihood that a person will repay a debt within the established time frame.

In the United States, a country whose economy largely rely on credit, credit scoring is one of the most important fact about any individual.

What You Should Know About FICO Credit Score

The FICO credit score is a score between 300 and 850 points. From 670 the score is considered good, and from 800, excellent.

This score is taken into account when applying for credit cards, mortgages, insurance, car loans, and even opening accounts for utilities and cell phones. To improve your credit score, you must keep credit cards active and with a balance less than 30% of your credit limit, and pay all your debts on time. Once a year, everyone is entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion.

Although there are several credit scores, the most commonly used is FICO (Fair Isaac Corporation). It is based on a credit report created by one of the three major credit bureaus.

It is important to note that there are different methods for calculating your credit score, so there is no single credit score. Since credit companies and banks may use different methods to get your score. However, most companies use the FICO method to calculate credit scores.

What is Credit Report?

The credit report is a compilation of information about how a person manages their credit and debt. It includes how much you owe, where you work, how you pay your debts, where you live, whether you have filed for bankruptcy, whether you have had a foreclosed home, judgment for nonpayment, a repossessed car, and so on.

How does the FICO credit score affect you?

A FICO score can affect a wide variety of financial situations. The most common are listed below.

Credit Card Application

The credit score determines, if the petition is approved and the interest rate applied. The lower the FICO credit score, the higher the interest.

Renting a home

Large real estate companies use the FICO score to approve or deny a rental application. People who do not have good credit are limited to renting house to small companies or individual landlords.

Auto Insurance

Insurers rely on the score to decide whether to insure a driver and the premium. One factor is the driver’s credit history, along with his or her previous accident and insurance history.

Cell phone bills and utilities

Some companies that provide telephone, electric, water, or cable services use credit score to determine whether they require a prepayment or deposit amount as a condition of service. The cost of the service may also be higher.

Mortgages

It’s hard to get a mortgage, if you don’t have a good FICO credit score. The solution in these cases is to find a local bank, credit union or small lender that does an underwriting manual instead of using the FICO score. The underwriting manual takes into account how long a person has paid monthly bills such as rent, cell phone or utilities on time.

Auto Loans

Car dealers approve customers with good credit scores more easily and on better financial terms, although the information on which they base their decision is broader than just the FICO number.

Your Credit History and Career Opportunities

No company can deny employment to a person because they have a low FICO number. However, you may decide not to hire a candidate if you believe that he or she has an unacceptable credit history.

This employment credit report contains information such as the amount of debt for mortgages, student loans, cars, credit cards, etc., and payment history. However, it does not include the FICO score.

In 11 states, this practice of credit reporting is prohibited without the consent of the job seeker.

What is a good FICO score?

The FICO credit score ranges from 300 to 850 points and is governed by the following guidelines to determine how good it is:

- Less than 300: no credit history or less than 6 months old

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- More than 800: Exceptional

As a general rule, credit applications are approved to individuals with a good rating or above. The very good or exceptional one is usually accompanied by a lower interest rate.

Because credit scores affect people’s financial and daily lives, having a good FICO score makes life in the United States easier.

How is a FICO credit score calculated?

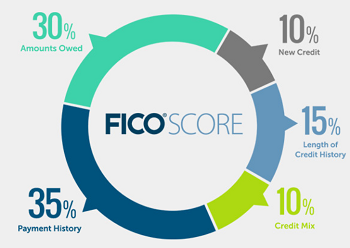

To determine a person’s FICO score, the following factors are computed and given different weights.

Payment History: Is the most important factor, accounting for 35% of the total FICO score. They negatively affect late payments, unpaid debts recovered by a collection agency, foreclosures, bankruptcy filings, etc. The most recent problems carry more weight than those that occurred years ago.

Amount Owed: This makes up 30% of the FICO score. It is the amount of debt a person has compared to his or her credit limit. It is recommended that you keep your credit card balance below 30% of your limit.

Length of credit history: It is 15% of the FICO score. For this reason, it is advisable to keep older credit accounts open and continue using them.

More about: Credit history in USA

Number of requests to verify a person’s credit is 10% of the FICO score. This is known as Inquire. And for FICO only those applications related to applying for a new credit (known as hard inquire) are taken into account. Only those made in the last year are computed, although they remain on the credit report for two years.

Types of credit: Finally, the different types of credit available make up 10% of the FICO score.

How can I improve my credit score?

In order to get a good credit score, it is necessary to buy something on credit and pay the credit on time.

Read: 4 ways to get first credit card in USA

One of the simplest and most common ways to build your credit history and improve your score is to take out a credit card, make small purchases with it and, each month, pay that debt in full or leave a small balance outstanding that is less than 30% of the credit limit.

The main financial products that improve credit scores are credit cards and loans of all types. In contrast, debit or prepaid cards are not counted for credit history, nor is the amount of money held in a bank account.

In addition, keeping old credit cards active and with a balance less than 30% of the credit limit contributes to raising the FICO number. For this reason, it is not advisable to close old accounts or leave them inactive. To improve your credit score, older accounts are more important than new ones.

Finally, failure to pay a debt on time, repossession of assets by a collection agency, bankruptcy and other financial problems damage the credit score and remain on the credit record for seven years. Once that period of time has passed, they do not affect the FICO.

How to get credit score?

If you want to know your credit score you can install the following applications on your mobile to know your credit score, for free.

1) Wallet Hub

The Wallet Hub application lets you know credit score for free. To get your score you don’t need to add your credit card information. In addition, the Wallet Hub monitors your credit 24/7 and gives you tips on how to improve your score. Wallet Hub is available for iPhone and Android.

2) Credit Karma

With Credit Karma you can get a credit score from TransUnion and Equifax. You can also monitor your credit with the application to keep you informed of any changes. The Credit Karma application is available for Android and iPhone.

Author Bio:

Hi, I am Nikesh Mehta owner and writer of this site.

I’m an analytics professional and also love writing on finance and related industry. I’ve done online course in Financial Markets and Investment Strategy from Indian School of Business.

I’m an analytics professional and also love writing on finance and related industry. I’ve done online course in Financial Markets and Investment Strategy from Indian School of Business.

I can be reached at nikeshmehta@allonmoney.com. You may also visit my LinkedIn profile.