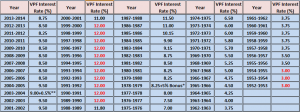

VPF Interest Rates 2013-2014 till 1952 by EPFO

Historic VPF Interest Rates

VPF interest rates are fixed by India’s retirement fund body – EPFO (Employee Provident Fund Organization) every year. The interest rate of 12% was the highest between the year 1989-2000 and since then it has seen a decrease.

For the year 2013-2014, the VPF interest rate of 8.75% up by 0.25% from the previous 8.50% was approved by the EPFO in the month of January 2013. Average historic rates have been between 8%-9%. For the year 2014-2015, interest rate is expected to be less than 9%.

According the data by EPFO, income of INR 25,048 crore was estimated for the financial year 2013-2014. By increasing the interest rate by 0.50%, INR 25,005.41 crore would be needed for the VPF payment for interest rate and the surplus estimated was INR 43.14 crore.

Displayed in the image below is the historic voluntary provident fund (VPF) interest rate from 1952 till 2013-2014:

In the year 1978-1979, EPFO celebrated golden jubilee year and a bonus of 5% bonus was declared. Cells marked in red shows the highest and the lowest voluntary provident fund interest rates in India. Read more about the VPF benefits and contribution limit

Interesting Facts about EPFO Claim Settlement

1) It is mandatory for EPFO to settle claims within the 30 days of making application

2) Universal or permanent account number (UAN) will be allocated to the 50 million subscribers by October 2015 and the number would be common for all the schemes run by EPFO.

3) The project for implementing UAN numbers is assigned to C-DAC which was established in the year 1988 and since then has carried out numerous IT & technology projects for Indian ministry and Government of India.

4) EPFO receives over 1.2 million applications for claim settlement

5) Online transfer of PF account was started in October 2013 since the cumbersome process of transferring the PF account was turning out loss making as subscribers were more interested in closing their accounts (both PF & pension account) and withdrawing the money instead of the manually applying for the transfer.